Getting My Fresno Cpa To Work

Wiki Article

10 Easy Facts About Accounting Fresno Described

Table of ContentsThe Certified Cpa PDFsThe 8-Minute Rule for Certified AccountantThe Main Principles Of Fresno Cpa Rumored Buzz on Certified Accountant

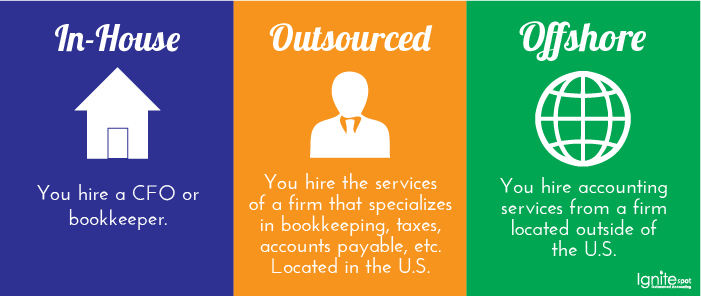

Getty Images/ sturti Contracting out audit services can free up your time, prevent mistakes and also decrease your tax expense (certified accountant). The dizzying selection of services might leave you frustrated. Do you require a bookkeeper or a state-licensed accountant (CPA)? Or, maybe you desire to handle your general audit jobs, like balance dues, however work with a professional for capital forecasting.

They might likewise reconcile financial declarations and document repayments. Prepare and submit tax returns, make quarterly tax payments, data expansions and take care of IRS audits. Local business owners also assess their tax concern and also stay abreast of upcoming modifications to avoid paying greater than essential. Produce monetary declarations, including the annual report, profit and loss (P&L), capital, and also earnings declarations.

, offer financial preparation suggestions and also discuss monetary declarations. You can contract out chief economic police officer (CFO) solutions, such as sequence planning as well as oversight of mergers as well as procurements.

3 Easy Facts About Certified Cpa Explained

Frequently, small company proprietors contract out tax solutions initially and also include pay-roll assistance as their firm expands., 68% of respondents use an external tax professional or accountant to prepare their company's tax obligations.Create a listing of processes as well as duties, as well as highlight those that you want to outsource. Next, it's time to find the ideal bookkeeping service supplier. Since you have a concept of what kind of audit solutions you need, the question is, that should you work with to supply them? While an accountant deals with data access, a CPA can talk on your behalf to the Internal revenue service as well as give economic suggestions.

Prior to choosing, think about these questions: Do you desire a local accounting professional, or are you comfy working practically? Does your business need sector expertise to do bookkeeping tasks? Are you looking for year-round aid or end-of-year tax obligation monitoring services?

10 Simple Techniques For Accounting Fresno

Specialist business suggestions, information, and also trends, delivered once a week By joining you accept the carbon monoxide Personal Privacy Policy. You can pull out anytime. Released November 30, 2021.

In the USA, the certified public accountant classification is controlled by private state boards of accountancy. To end up being a CERTIFIED PUBLIC ACCOUNTANT, an individual typically needs to complete a certain variety of college training course credit reports in accounting and business-related topics, obtain a certain amount of useful experience in the field, and also pass the Uniform Cpa Evaluation (CPA Examination).

Monitoring or supervisory accounting professionals utilize economic details to aid companies make educated business choices. They are responsible for supplying economic data and also analysis to supervisors and establishing and also applying economic systems as well as controls.

Excitement About Certified Accountant

They may be entailed in activities such as preparing economic reports, creating budgets, assessing economic information, and also producing monetary designs to aid supervisors make informed decisions regarding the organization's procedures and also future direction. As opposed to accountants, that normally deal with a large range of clients and also concentrate on outside monetary reporting, monitoring accountants function mainly with the monetary info of a single company.

A Chartered Accountant (CA) is a specialist accounting professional that has actually fulfilled particular education and learning as well as experience needs and has been provided an expert certification by an identified accounting body. Chartered Accountants are usually considered amongst the greatest degree of expert accountants, and the CA designation is acknowledged as well as valued worldwide. To end certified cpa up being a Chartered Accountant, an individual generally requires to finish a particular level of education in accounting and associated subjects, get a certain quantity of practical experience in the area, and pass a specialist accreditation exam.

Several different expert audit bodies approve the CA classification, consisting of the Institute of Chartered Accountants in England as well as Wales (ICAEW), the Institute of Chartered Accountants of Scotland (ICAS), as well as the Institute of Chartered Accountants in Ireland (ICAI). The demands and treatments for coming to be a Chartered Accountant vary relying on the specific professional body (accountants).

Report this wiki page